A Cash Receipt Can Occur From Which of the Following

The salvage value of the assets used in the project would be. Give a cash register receipt to every customer AND restrict access to the cash register.

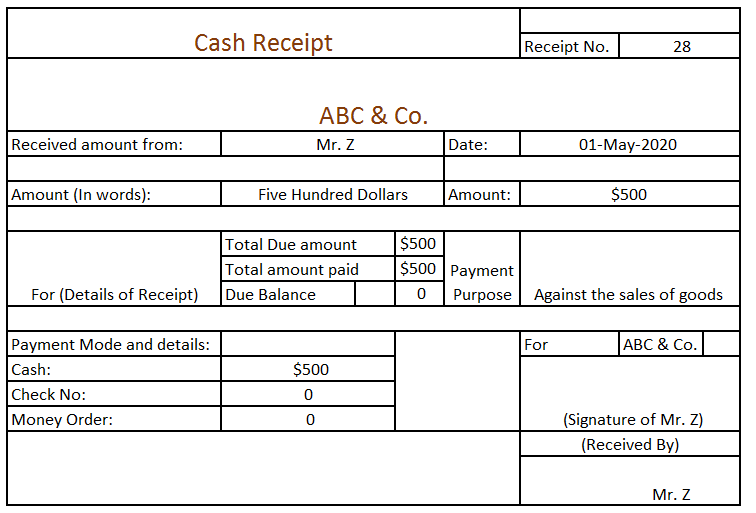

Cash Receipts Complete Guide On Cash Receipts In Detail

Darlene Wardlaw Subject.

. Most companies use their cost of capital to estimate the minimum return on investment. Ive attached a Sales internal control questionnaire from another engagement that I think you can use for Apollo. 12- 19 Objectives 12 - 2 12 - 3 The following are misstatements that can occur in the sales and collection cycle.

A cash advance of 1000 on october 10. Choose 2 Adjusting accruals Selling a product or service Reimbursement of overpayment Expired insurance premiums. Recording cash receipts offsets the accounts receivable balance from the sale.

If you have a cash sale you are responsible for recording a cash receipt. A cash receipt can occur from. When recording cash receipts increase or debit your cash balance.

This conversation has been flagged. A customer receives a new credit card and makes the following transactions. For each check received state on the form the name of the paying party the check number and the amount paid.

Ensure to select the correct printer in the preferences. While examining cash receipts information the accounting department determined the following information. Restricting access to cash by locking it up AND comparing cash in registers w cash count sheets AND completing bank deposits.

The business can reconcile to the banks balance at any time. 13 JAN 2012 74253 0000 From. A companys book balance will always equal the banks balance.

AR subsidiary ledger is separated from the general ledger GL. Record Checks and Cash. Choose File Preferences Workstation.

Solution The correct answer is. The further into the future a cash receipt is expected to occur the lower is its present value. Account balance into agreement with the banks account balance.

Which one of the following can occur if the operating cycle decreases while both the. The AR subsidiary ledger the cash receipts journal and the general ledger should be separately maintained. Each days receipts can be kept separate by preparing a deposit slip for each day.

Cash basis accounting c. Good internal controls for cash receipts that should be performed by a supervisor include ___________. 2011 Revenue and Cash Receipts Cycle Internal Control.

Tax basis accounting d. The following can cause this issue to occur. The return on investment measures the compensation a company expects to receive from investing in capital assets.

Cash drawer is pointing to the wrong printer in your preferences. Eliminates the need for some internal controls because these payments are not processed by employees at the company 5 Which of the following is a benefit of online banking. When the daily mail delivery arrives record all received checks and cash on the mailroom check receipts list.

Purchase Order would require a cash receipt. Your print template is damaged. Added 6292018 34208 AM This answer has been confirmed as correct and helpful.

Credit account titles are. A customer number on a sales invoice was transposed and as a result charged to the wrong customer. Purchases on store credit.

Bank account is the process of explaining the differences that bring the companys cash reconciliation. The business can reduce their internal. Understanding the Revenue Cycle Attachment.

The following cash flows occur in the last year of a 10-year equipment selection investment project. If your organization is a small nonprofit managed by volunteers and possibly one staff person this principle can be hard to put into practice. The annual cash receipts would be 126000 and the annual cash expenses would be 57000.

Accrual basis accounting b. Budgeted the following cash receipts and cash disbursements for the first three months of next year. Revenues and expenses must be recorded in the accounting period in which they were earned or incurred no matter when cash receipts or outlays occur under which of the following accounting methods.

Her due date on the bill is november 3 and yearly. The procedure for check receipts processing is outlined below. Log in for more information.

Which one of the following commences on the day inventory is purchased and ends on the day the payment for the sale of that inventory is collected. Moore Moore has just finished projecting its expected cash receipts and expenditures for next year. Prepare the required journal entry based upon the cash count sheet.

Round answers to 2 decimal places eg. She then makes 2000 purchase between october 12 and october 21. Receipt printer is cutting the receipt many times before it finishes printing.

The following payment methods are considered cash sales. Opening cash balance 177 cash on hand 132837 and cash sales per register tape 116657. According to a credit agreement with the companys bank Franke promises to have a minimum cash balance of 20000 at each month-end.

For cash disbursements this might mean that different people authorize payments sign checks record payments in the books and reconcile the bank statements. Cash receipts function are separated from AR and cash account functions. In return the bank has agreed that the company can borrow up to 160000 at an annual interest.

A petty cash fund of 100 is replenished when the fund contains 3 in cash and receipts for 93.

Cash Receipt Format Uses Cash Receipt Journal Examples

Comments

Post a Comment